Master in Financial Engineering

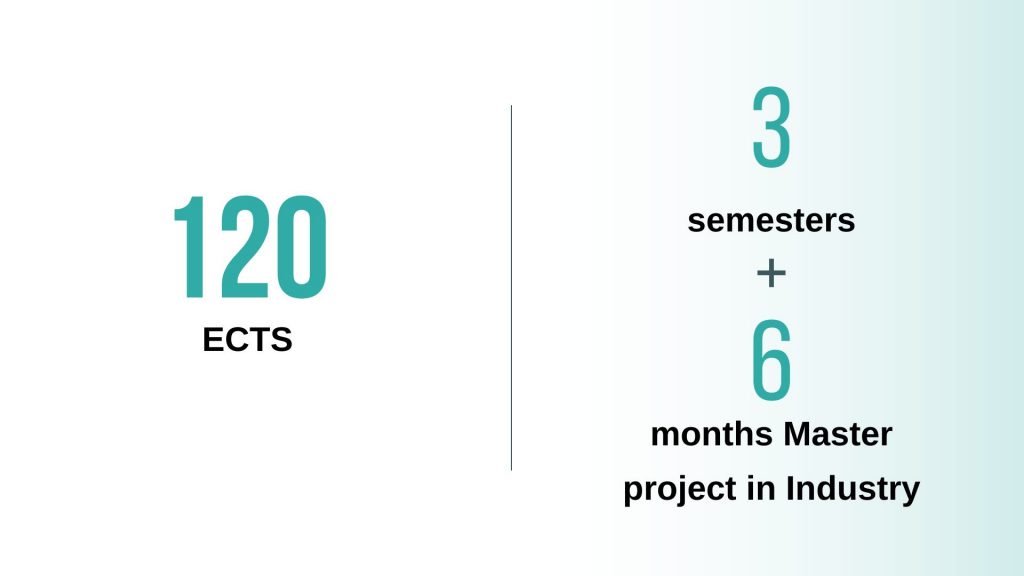

The Master in Financial Engineering (MFE) is a highly selective two-year program that provides financial education at the forefront of both academic thinking and industry practice.

MFE PROGRAM OVERVIEW

Why join our Master in Financial Engineering?

- Academic excellence

- High-quality education from renowned professors experts in their fields.

- Building competences

- The program serves students seeking comprehensive technical knowledge of derivatives pricing, asset management, market design, and risk management.

- Unlock career opportunities

- It will open the door to a variety of career opportunities in the sectors such as: Banking, Hedge funds, Consulting firms, Commodities Company, Asset management, Insurance, and Fintech.

- A selective program

- Only 30 to 40 students join the program every year.

- A multicultural environment

- The MFE program welcomes students from +10 nationalities (Europe, Middle-East & Africa, the Americas, and Asia).

- A diverse students’ background

- Students in MFE come from different backgrounds such as Mathematics, Engineering, Physics, Computer Science, Economics, Electrical Engineering, Statistics & Communication systems.

MFE PROGRAM STRUCTURE

Examples of courses:

- Introduction to finance

- Accounting for finance

- Econometrics

- Global Business environment

- Optimization methods

- Probability & stochastic calculus

Examples of courses:

- Derivatives

- Investments

- Financial econometrics

- Interest rate and credit risk models

- Advanced derivatives

- Quantitative risk management

Examples of elective courses:

- Financial applications of blockchains and distributed ledgers

- Computational finance

- Financial big data

- Venture capital

- Intelligent agents

- Machine learning

- Machine learning programming

- Macrofinance

- Mathematical modeling of behavior

- Numerical approximation of PDE’s

- Regression methods

- Risk, rare events and extremes

- Time series

The curriculum of the MFE is completed by a 6-month internship in the financial industry. During this period, each student must write a master thesis under the joint supervision of their internship advisor and one member of the MFE faculty acting as an academic advisor. For more details on the internship and master thesis follow the link to the master project page.

THE MFE EXPERIENCE

Choosing EPFL and the MFE after my French engineering school has allowed me to set a foot in the world of finance. The high quality courses in both mathematical aspects, computer based analysis and corporate finance have trained me well for banking jobs, giving me a broad horizon of what finance has to offer for young professionals.

During the MFE, I could really challenge myself and learn a great amount of useful skills which eventually made possible to land a job I like. The learning environment is extremely stimulating and, combined with the high level of internationalization, I could empower my soft-skills as well.

The MFE offers a great diversity in its curriculum, allowing one to fully take a grasp of how mathematics are used in finance. With a strong alumni network and being an EPFL master, the MFE allows its students to start their careers with a strong and robust basis in their bags.

FAQs

Applications have to be filled online only. Check out the application process.

The application period is from:

- The beginning of November to December 15th

- December 16th to 31st of March

To learn about eligibility conditions, the application process and the important deadlines

If you’re new Master student on EPFL campus, you can find tips & procedures to follow about immigration, housing & insurance

Application deadline

Applications can be filled out online from the beginning of November to the 15th of December, or from the 16th of December to the 31st of March

CONTACT US

Odyssea Building | Office 3.18Phone: +41 (0)21 693 01 22[email protected] |

|